There’s a lot of national alarmism about the prospect of a recession, but economists Ray Perryman and Karr Ingham are not buying it. Acknowledging that the economy has shown the classic symptoms of two straight quarters with drops in the gross domestic product, they say continued strong job growth and a powerful worldwide need for oil and gas are belying the naysayers.

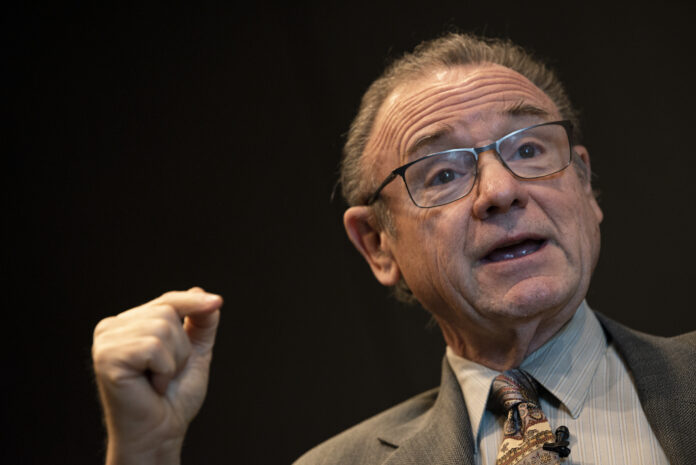

“The economy is clearly facing strong headwinds, but at least at this point it does not appear to be headed to more than a very mild recession, if one at all,” said Perryman, an Odessan who works in Waco. “Many people use the rule of thumb of two straight quarters of GDP decline, which we’ve had, but that can be deceptive.

“In the first quarter the decline was due to a rise in imports, which subtracts from GDP in national income accounting. What that basically means is that we were unloading more ships and getting goods into the supply chain.

“The second quarter was a bit more problematic, but some key areas such as consumer spending remained relatively strong. Underneath all that, recessionary economies don’t gain over 10,000 jobs a day. I think that may well slow down some, but I doubt that it becomes negative for any sustained period.”

GDP is the total sales of all goods and services in the nation, which in the last quarter amounted to $24.85 trillion.

Perryman said inflation, supply chain disruptions and a virtual lockdown of the Chinese economy “are all notable challenges.

“But given the ongoing demand for petroleum products, enhancements to capacity and rapidly rising demand for natural gas globally, I do not expect the energy sector to be particularly affected by any slowdown at this point,” he said.

“Rig counts are on a decidedly upward trajectory and capital seems to be flowing into drilling and production. There are longer-term concerns such as government policy that is at odds with the economic reality, but I don’t think the current state of the economy or its path over the next year or so are going to notably impact the current path of oil and gas activity.”

Ingham, a petroleum economist for the Texas Alliance of Energy Producers who works in Amarillo, said the GDP’s 6.9-percent increase in the fourth quarter of 2021 preceded decreases of 1.6 percent in the first quarter this year and .9 of a percent in the second.

“If we are in a recession right now, it’s one of the more interesting events I have ever seen because recessions are virtually always characterized not just by a decline in the GDP but also by other measures of economic activity, most notably employment and general spending,” Ingham said.

“Right now we have really stout employment growth nationally and we still have growth in consumers’ spending activity with retail sales. A deep recession would be characterized by jobs loss, a spending decline and quite possibly a decline in energy demand, so I don’t have the feeling that we are headed for one.

“When was the last time you saw a recession with four-percent employment growth?” he asked. “It doesn’t make sense. These two things have to be resolved at some future point because we can’t have GDP and employment moving in different directions for any sustained period of time.

“There is a demand for those workers, which belies the notion of a recession.”

Ingham said inflation “is clearly having a lot to do with this with the federal government’s overspending and the U.S. economy’s continuing attempt to disentangle itself from COVID.

“Now the Biden administration is talking about spending another $700 to $800 billion, which is anything but inflation reduction,” Ingham said. “That’s totally overdoing it, but we just keep doing it. It’s pouring more gasoline on the fire.”

Noting that America’s last two recessions were 2020’s COVID-related one and the very hurtful one of 2008-09, he said a recession would affect the oilfield with less demand for energy.

Asked if the momentum would be taken away from the Texas oil and gas business by a worldwide recession, Ingham said, “We would be caught up in that because everything is interconnected in the global economy.

“But we might be buffered a little because we run our economy in a different and better way with our markets. We’ll be better off as long as our economy is left to respond to market outcomes and is open to trade from the rest of the world.”